Modern

THE NAME OF Oswald Chambers is well known to millions of Christians for a collection of notes gathered by his wife from his sermons and published as a devotional reader in 1927, 10 years after his death, under the title My Utmost for His Highest.

Like many Christians, I first read this devotional guide while still in college and harbored the suspicion that this man must have been a somber if not puritanical pillar of the faith. The gaunt, almost cadaverous portrait of him included in many editions of his most famous work contributed much to these impressions of mine. It turns out, though, that I did not know the human being who was Oswald Chambers.

I recently stumbled upon a crumbling book in the library stacks of a local university that greatly altered my perceptions of him. It was an out-of-print collection of tributes by those who knew him best, along with his personal diaries from his travels abroad as an itinerant preacher and as a YMCA chaplain in World War I until his sudden death from complications following an emergency appendectomy at the age of 43. As I read through these documents, I found myself strongly attracted to Chambers as a person and captivated by his vision of what it means to be a believer in the modern world.

AS A STUDENT of art at the University of Edinburgh, Chambers was not known among his peers for his religious devotion, which he had received from devout Scottish Baptist parents. He was better known, rather, for his outgoing personality and his knowledge and love of poetry, art, and music. He was gifted not only with a keen aesthetic sensitivity and outgoing temperament, but also with a rigorous mind. After completing his studies he became a tutor at Dunoon College in Scotland in 1898, where he taught logic, moral philosophy, and psychology for several years.

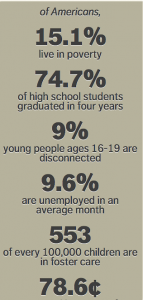

Perhaps the most important finding from the report is that we have both the experience and the policy tools necessary to cut poverty in half.

Between 1964 and 1973, under both Democratic and Republican administrations, the U.S. poverty rate fell by nearly half (43 percent) as a strong economy and effective public policy initiatives expanded the middle class.

Similarly, between 1993 and 2000, shared economic growth combined with policy interventions such as an enhanced earned income tax credit and minimum wage increase worked together to cut child poverty from 23 percent to 16 percent.

We can't do this alone.

As Christians concerned about poverty, it is time to turn our full attention to the injustices of an "offshore tax system" that enables corporations and the wealthy to dodge taxes and impoverish countries around the world.

As members of Congress in the United States debate deep and painful budget cuts, people of faith should raise our voices against an unfair system that enables profitable U.S. corporations to dodge taxes, depleting an estimated $100 billion from the U.S. Treasury each year. Instead of cutting $1 trillion over the next decade from programs that assist the poor and ensure greater opportunity, we should eliminate these destructive tax gimmicks.

Recent reports show that aggressive tax dodgers such as General Electric, Boeing, and Pfizer, avoid billions in taxes a year. They use accounting gymnastics to pretend they are making profits in offshore subsidiaries incorporated in low- or no-tax countries like the Cayman Islands, thereby reducing their tax obligations in the United States. This system is unfair to domestic businesses that have to compete on an un-level playing field.

With all the recent and well-deserved attention on the work of Gene Sharp, it shouldn't come as any surprise that a film about the foremost living strategist of nonviolent action is soon to be released.

In 2010, the moral measure of tax policy choice is: Does it further concentrate wealth and power in the hands of a few?

Thirty turkeys per minute. Airport scanners. Hogwarts. Here’s a little round up of links from around the web you may have missed this week:

- Workers in turkey plants handle as many as 30 turkeys per minute.

- How to make the perfect pie crust.

- This Thanksgiving, remember the hands that feed you.

- Opposed to the new airport scanners and aggressive patdowns? So is Captain Sully.

- A photographer turns his aging and depressed grandmother into a superhero.

- Fast Company asks, “Who are the CEOs of Hogwarts?”

- Speaking of Hogwarts, did you read Julie Clawson’s blog about Harry Potter and Social Justice?

- A reluctant uncle witnesses the home birth of his nephew.